Never download any app from unknown source, you may become prey of cyber fraudsters.

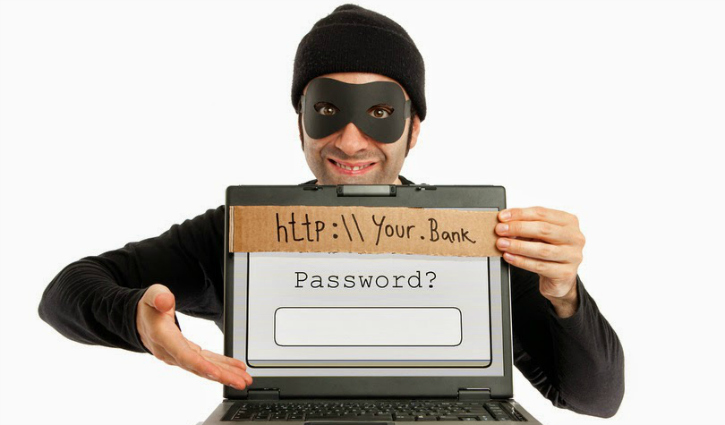

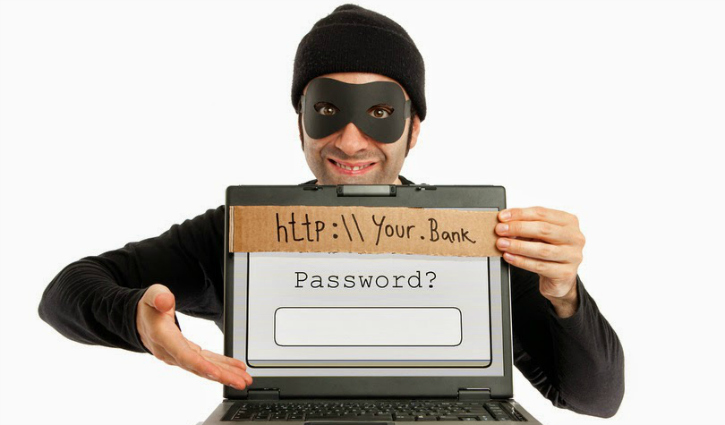

Digital payments have gained popularity among consumers but have also brought in the threat of cyber criminals placing fake e-wallet apps to dupe users. All internet users who use various applications on their smartphones are very prone to getting duped by cyber fraudsters. Many offer messages go viral on social media which offers lucrative benefits for installing any software or upgrade any existing application to continue services. These messages show various benefits like cash back, free data and others so that users initiate to download from the link. But, such downloads may contain a malware or malicious software which can be used to steal any secret information related to your banking or other mobile apps.

Recently various messages like upgrading Reliance Jio app to add more data and enhance free data usage beyond free data period, add instant money credit into e-wallets and etc were spread on Whats App but these messages were found to be fake as companies denied such offers or messages sent to the customers.

According to cyber security solution firm Kaspersky, no such incident has been reported yet but the probability of cyber criminals adding fake apps on app stores remains high. Digital payment companies ensure that the transactions are safe on their apps. Besides, there are checks like two-factor authentication for ensuring secure transactions for consumers. In such a scenario, cyber criminals could look at tricking consumers into downloading fake apps that look almost like the genuine one, allowing a backdoor entry into their smartphone.

While financial institutions like banks and mobile m-wallet companies take steps to protect customer information, users also need to take precautions as negative experiences could lead to losing trust in digital transactions. The government’s move to demonetise high-value currency notes in November last year has given a massive push towards adoption of digital payment methods including credit/debit/ Rupay cards, UPI and mobile wallets. The government had also launched BHIM app to facilitate e-payments. Launched on December 30, the app has already been adopted by over 125 lakh people.

The convenience that digital payments bring is massive. However, there are also risks involved. Consumers need to be informed and careful when they download app. They should ensure they are downloading the genuine apps and not the fake ones.

How consumers could spot the fake apps? The fake ones almost resemble the real ones but there is still a difference. The logo might look exactly same but the spelling might be different. The key is to carefully check before downloading just any app. It is further advised that do not download any application from the link shared through chat messengers, emails or received through any unrecognized source. Better to avoid getting benefits than losing your secret information to the hackers.

Besides, consumers should install security solutions on their phones. Security solutions like antivirus, firewalls must be installed to block auto download of malicious application. Since a large number of consumers now carry out financial transactions through their smartphones, it is important that they protect it.

Currency Convertor

Currency Convertor Post an article

Post an article Prashant Singla, Axis Bank.

Prashant Singla, Axis Bank.

sending...

sending...