Know how you can live the life after retirement happily.

Sixty is the age of an individual when he declares himself retired. Retirement is discontinuation of one’s active professional life. Though most of people keep themselves engaged in various activities after retirement age but obviously due to long professional life, one cannot devote much time which a person can earn money from. But the point I am raising here – Life goes on after retirement but do the expenses stop? No way! Due to increasing life expectancy everyone has to arrange for 15-20 years funds to meet the life expenses after the retirement. To meet everyday expenses, medical expenses due to age related ailments and other unexpected expenses we must have sufficient savings.

Here I would like to give very appropriate example easy to understand, you must have seen a fruit tree which is harvested in every season. Planted a long time ago, tree gives fruit every year. Same is with your savings for future which you start at a particular age and strategically save to meet your future expenses after the retirement age, when you will not have sources of earning but expenses will be the same. People living in present without proactive approach of raising sufficient funds for future face lots of problem in the retirement age. Here I would like to mention some important points which are mandatory for all especially private sector working people who do not get any pension or provident funds after the retirement and business class people.

The age when one must start planning for a smooth retirement life is immediate after getting job. It’s best time to save money because as single responsibilities and liabilities are minimum and savings can be maximum at this age. For instance of one gets employed at age of 23, should have gap of three to four years to get marry. In this period, invest money in long term investment plans which give good returns. Invested money in this period will be catering to sudden and unexpected needs in future.

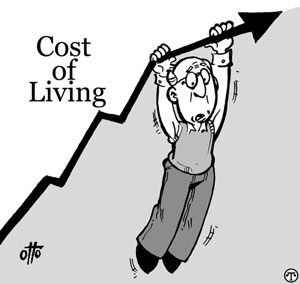

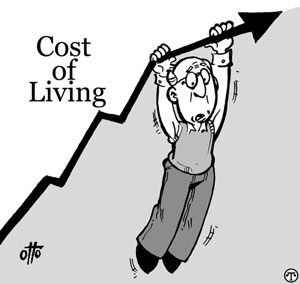

Generally we have big expenses on education of children, owning a house and some important life tools like cars, home furniture and other amenities. Apart from this some expenses carry on with the life carries on, like utility bills of telephone, electricity, gas etc, daily food and grocery, clothes. When I was a student, electricity cost Rs two per unit which now costs Rs seven per unit. When I bought first vehicle, petrol cost Rs 27 per liter which now costs Rs 65 per liter. I happened in a time span of twelve years, I have still twenty four years in my retirement, means prices will be soaring that time. Will I be paying seven rupees per unit for electricity? Will I be paying sixty rupees per liter for petrol? No way, every year prices of all things from a needle to cars rise and these rising prices are known as ‘Inflation’.

Inflation affects prices of every sold product in the market, all services including telecom, medical, railways and average rate which it rises is 5-6%. Though it rose more than 10% in some years but here we freeze and average. So, if you are thirty now, you will be paying three to seven times more than you pay now of any product. Due to shrinking to agriculture land, prices of food and edible products will also be rising. So, first of all we need to plan how much we have to save for a smooth retirement life.

First calculate you assets which are owned by you. You may count your parents assets as well if they intend to heir you. If you have parentage house and you will live with your spouse and children in that house, you will not have to buy a house for yourself, means you have to save money for your expenses only. But if you intend to buy you own house, you will have to save for your house as well.

Calculate your regular expenses – Calculate your regular expenses which occur daily or monthly. Mainly these expenses include –

- Daily food and kitchen expenses which include flour, sugar, pulses, vegetables, milk etc.

- Regular bill like electricity, water, gas, telephone and other utilities.

- Transport and fuel expenses.

The above expenses are those which are basis life needs and continue as long as one survives. Apart from these, some expenses are there which are in our control like holidays, leisure and entertainment, dining out, merchandise. These expenses do not occur itself but are important to live life with enjoyment.

There are sudden expenses as well which can never be predicted. Any ailment or sudden emergency situation like accident ends up with huge hospital bills. One has to be ready with this as well as there is no prediction when perils knock us.

Now you have calculated all your expenses and you know your current financial condition. If you want to live a dependant and compromising retirement where you kill your desires and live life in a dull way, there is no need to save money. But if you want to live uncompromising life with liberty to fulfill your desires, save money for smooth old age. You can see old age homes flooded with old people who despite being from good financial background spend last stage of life in such agony.

Life after retirement is very beautiful, live it with full enjoyment and be smiling till last breath. This will be called a lived life.

Currency Convertor

Currency Convertor Post an article

Post an article Covid19 Updates

Covid19 Updates Abhishek Sharma

Abhishek Sharma

sending...

sending...