If you own a vehicle, you must know these things about vehicle insurance.

We love our vehicles, especially cars which we always want in a new look and spend time & money for its maintenance and long life. Apart from service, repairs and other maintenance, another investment that we have to do for vehicles is vehicle insurance. Indian motor vehicle act mandates all vehicles driven on the roads to be insured and vehicle on the road without insurance is liable for hefty penalty. Thus, to avoid penalty, all people insure their vehicle. Today, we understand what exactly is motor insurance and on what principle does it work.

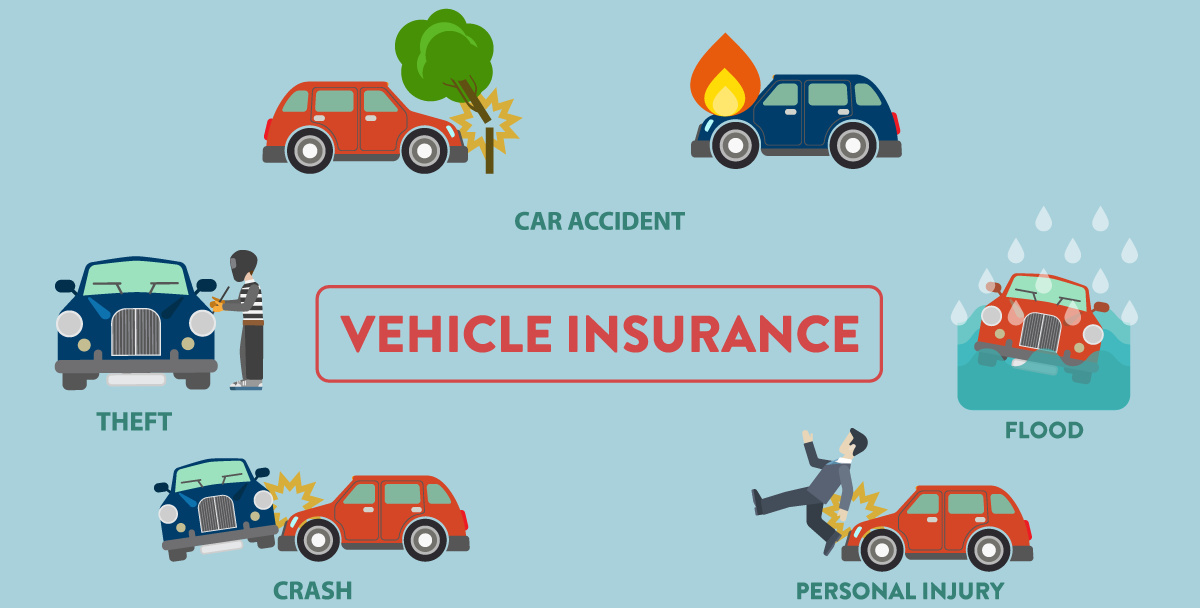

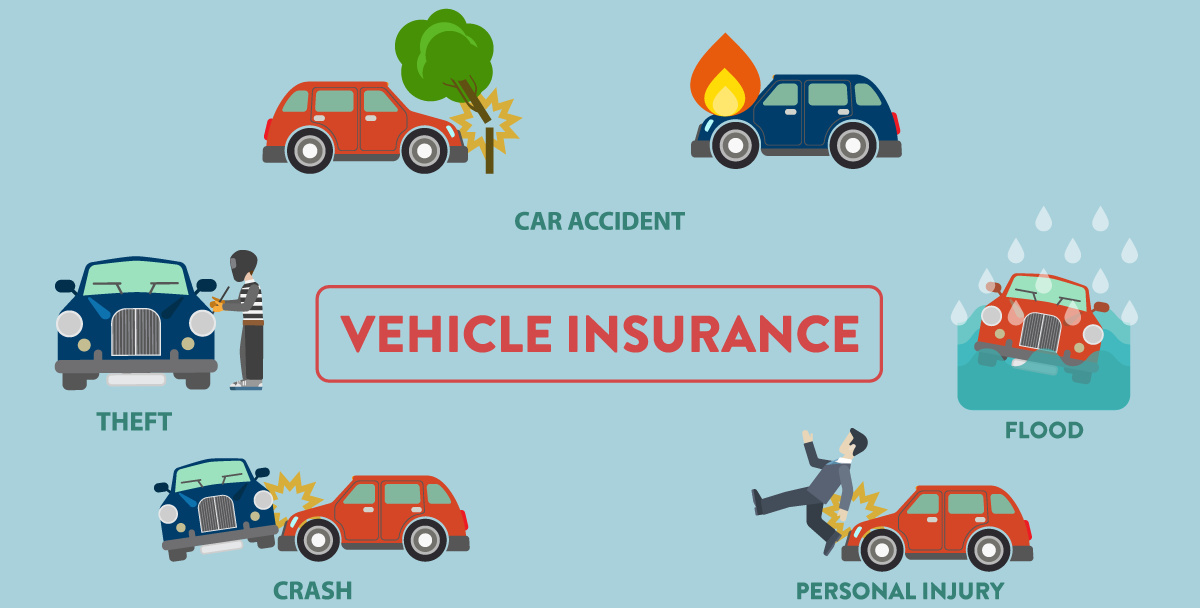

Vehicle insurance is a term which keeps your vehicle, the driver and other people on the road under a monetary protection in case of any accident, theft or other damage to the vehicle or people suffering injuries or causalities in the accident. You have to pay a premium amount to the insurance company so that your vehicle gets insured. In case of any damage or accident, the repairs cost will be borne by the insurance company. Thus, the damage cost which could be much higher than the premium paid to the insurance company, will be paid by the insurance company.

Many people think that in case they do not claim any loss or damage, the premium gets waste. But if you do not claim the damage or loss, you get the no claim bonus which may be 20% to 50% of the basis premium amount depending upon the age of your vehicle. With the age of your vehicle getting older, the premium amount will be getting lesser due to depreciation of the vehicle.

Many people insist evaluators to further depreciate vehicle to make third party insurance. We can never predict when something unpleasant can struck us and if your vehicle is fully insured, all damage cost under the insurance will be paid by insurance company which can be several thousand rupees. Also, in case of vehicle theft, the insurance company will compensate the owner with the evaluated value of the vehicle.

When you insure your vehicle, ask the company about all details of the insurance and what all is covered under the insurance you are being offered. Generally, insurance covers following damages to the vehicles –

Damages due to natural disasters – Some situations which are beyond man’s control like earthquake, thunders, cyclones, landslides, floods, lightening etc.

Man’s created hazards – Some hazards created by people like strikes, riots, stone pelting, thefts, plundering, damage in shipping etc.

Accidental – Any collision with any object or other vehicles or person. Insurance company covers vehicle damage as well as driver’s injury or causality.

Third party cover – This component is mandatory for all motorists on the road. It covers damage, injury or causality to other people, vehicles or other damages due to accident. In case one driving vehicle without third party component in the insurance, it’s vehicle owner’s liability to bear damages or face trial under court of law.

What’s all not covered under insurance –

Insurance company gives maximum cover in case of any mishap, but there are some things which are not covered under insurance or claim may be rejected by the insurance company. Here are these –

- Driving vehicle under influence of alcohol or drugs.

- Driver not authorized to drive or does not possess valid driving license.

- In case of mechanical or electrical breakdown.

- Vehicles accessories or merchandise not under insurance cover.

- Regular maintenance and repair cost.

- Vehicle being used for unauthorized purpose or used in restricted areas.

- Vehicle violated traffic rules or cautions displayed.

- Damage during war, military coup or bombardment.

It’s how insurance works and why it’s mandatory for all motorists to cover their vehicles under insurance. Do not take it as formality only and do not go for a third party insurance. Any unavoidable or beyond control situation can anytime struck anyone, so better to be prepare for it and minimizing the damage or loss incurring. Hope this post was useful for you.

Next time when you insure your vehicle, know all details and features attached to your insurance plan.

Currency Convertor

Currency Convertor Post an article

Post an article Covid19 Updates

Covid19 Updates Abhishek Sharma

Abhishek Sharma

sending...

sending...